Written by: Tradex

Carpe Diem – Seize the opportunity to meet with a Tradex advisor to explore today’s opportunities around declining rates.

Our team will be participating in Applaud’s Community Matters Events August 27th in London and September 17th in Peterborough. Additionally, mark your calendar for our upcoming webinar on September 11th, or register for one of the upcoming two pre-retirement courses, which will soon be offered in Ottawa and Toronto. Whether you join us at your events or connect with us online, we look forward to helping you navigate and capitalize on the current financial landscape.

Election Impact

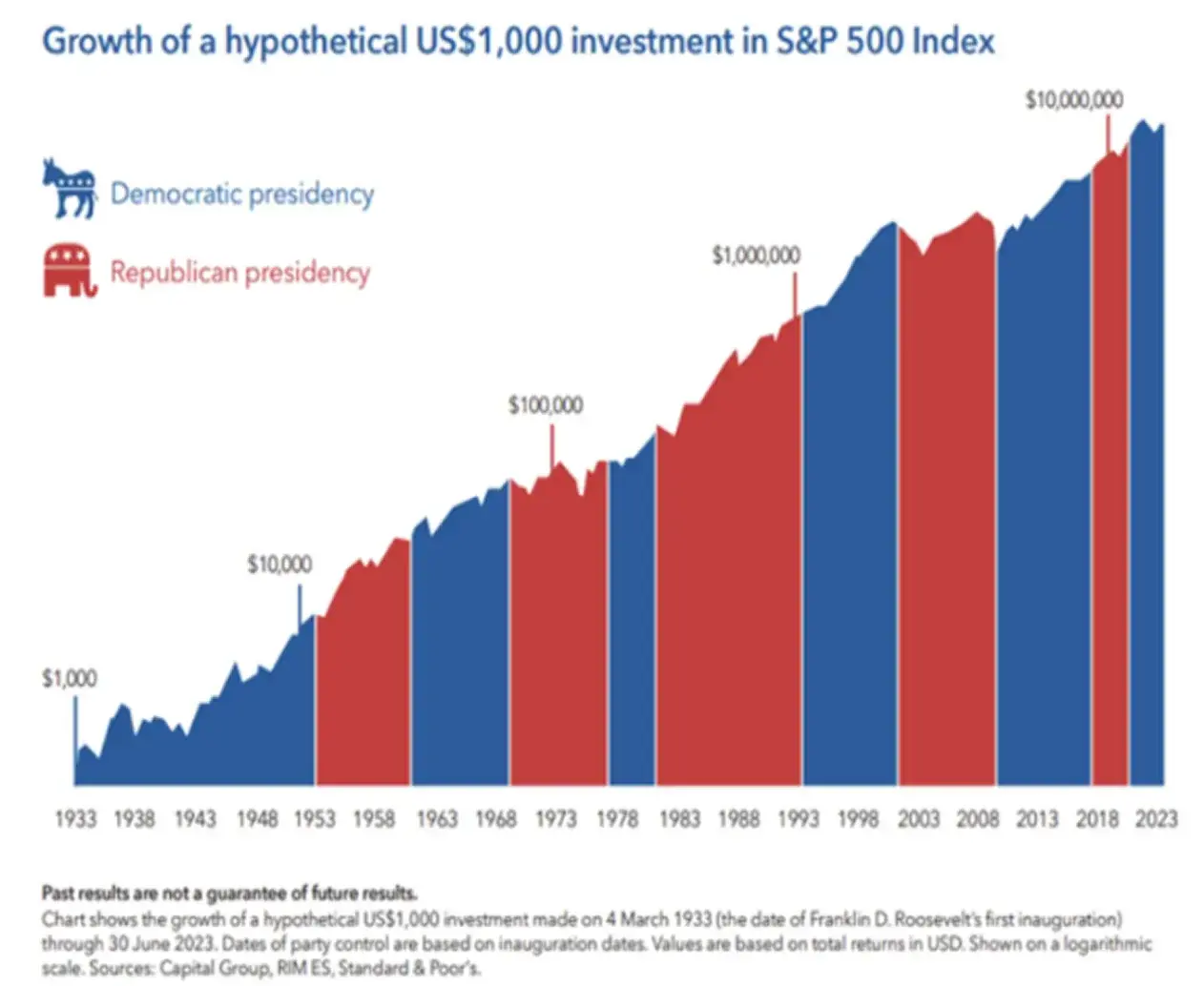

The impact of elections on investment returns is multifaceted, encompassing both short-term volatility and long-term economic policy effects. In the immediate aftermath of elections, investor sentiment plays a crucial role, often leading to heightened market volatility.

Carpe Diem – Seize the opportunity to meet with a Tradex advisor to explore today’s opportunities around declining rates.

Our team will be participating in Applaud’s Community Matters Events August 27th in London and September 17th in Peterborough. Additionally, mark your calendar for our upcoming webinar on September 11th, or register for one of the upcoming two pre-retirement courses, which will soon be offered in Ottawa and Toronto. Whether you join us at your events or connect with us online, we look forward to helping you navigate and capitalize on the current financial landscape.

Election Impact

The impact of elections on investment returns is multifaceted, encompassing both short-term volatility and long-term economic policy effects. In the immediate aftermath of elections, investor sentiment plays a crucial role, often leading to heightened market volatility.

Beyond the immediate impact, the correlation between elections and investment returns is complex and often nuanced. While elections can create short-term market volatility due to uncertainty or policy changes, their long-term impact on investment returns is generally less pronounced. This is because markets tend to react to a wide range of economic factors, global events, and corporate performance, which collectively drive returns over extended periods. Investors may adjust their strategies based on anticipated policy changes or economic shifts associated with election outcomes. However, historical data shows that markets typically exhibit resilience and adaptability, recovering from election-related fluctuations to focus on underlying economic fundamentals and business profitability. The primary driver of equity returns are profits, and companies adapt to political changes. Moreover, the effect of elections on specific sectors or industries can vary widely depending on proposed policies, regulatory changes, or economic priorities of incoming administrations. Hence, while elections can influence short-term market sentiment, prudent long-term investors maintain diversified portfolios and focus on fundamental analysis rather than making abrupt changes based solely on political cycles.

While the market impacts of political events are generally limited, ongoing government programs can offer significant opportunities for individuals. For example, the Home Buyer’s Plan allows Canadians to borrow up to $60,000 from their RRSP without immediate tax to put towards a down payment on an eligible home, a crucial financial boost. This plan can also be used in conjunction with a First Home Savings Account, introduced in April 2023, combining tax deductible contributions like an RRSP with tax free withdrawals for a home. Meanwhile, the RDSP offers long-term financial security for individuals eligible to receive the disability tax credit through government contributions and grants. The RESP helps families save for children’s post-secondary education with tax-sheltered growth and Canada Education Savings Grants, easing the financial burden of tuition. Lastly, the TFSA provides flexible savings and investment options with tax-free growth and withdrawals, empowering Canadians to save for various goals throughout their lifetime.

If you’re not leveraging these beneficial government programs to enhance your financial strategies and secure your future, consider speaking with a trusted advisor. A Tradex advisor can provide personalized guidance to help you take full advantage of these opportunities to help realize your long-term goals.