Written by: Tradex

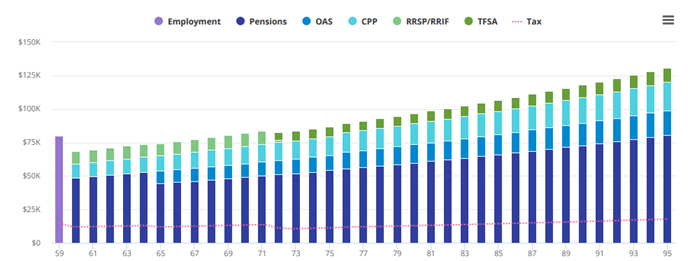

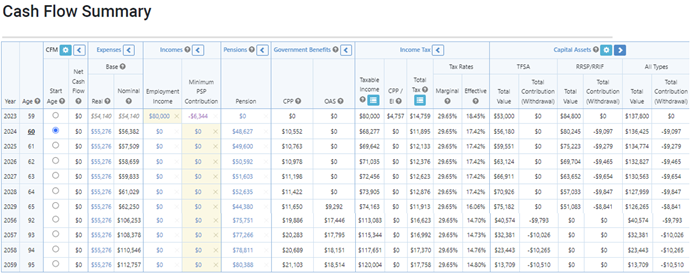

Over the last couple of months, we have reviewed the primary sources of income in retirement: your public service pension plan (PSPP), Canadian government pension plans and your personal savings. This month, we discuss the need to bring all these notions together with a Retirement Income Forecast.

As you prepare for retirement, you want to ensure that your retirement income is adequate with your expectations and goals. A detailed personalized retirement forecast will allow you to reflect on your retirement planning and assist in answering many financial questions.

Over the last couple of months, we have reviewed the primary sources of income in retirement: your public service pension plan (PSPP), Canadian government pension plans and your personal savings. This month, we discuss the need to bring all these notions together with a Retirement Income Forecast.

As you prepare for retirement, you want to ensure that your retirement income is adequate with your expectations and goals. A detailed personalized retirement forecast will allow you to reflect on your retirement planning and assist in answering many financial questions.

- When is the best time for me to retire?

- How much should I put aside to supplement my pension incomes?

- When is the best time to begin receiving CPP and OAS?

- Will I benefit from pension income splitting with my spouse?

- How do I minimize any OAS Clawback?

- TFSA or RRSP? How do I build an investment portfolio that fits my objectives?

- When should I make contributions (withdrawals) to my RRSP and/or TFSA?

- How does inflation affect my retirement lifestyle?

Our first in-person pre-retirement course for Ontario Public Servants is now SOLD OUT!

Attendees will get their questions on retirement answered and an opportunity to have a

FREE PERSONALIZED RETIREMENT INCOME FORECAST

Attendees will get their questions on retirement answered and an opportunity to have a

FREE PERSONALIZED RETIREMENT INCOME FORECAST

If you are not attending our in-person pre-retirement course but wish to have a retirement income forecast, you can download the retirement questionnaire here and send your completed form by email at info@tradex.ca. For more information, please contact us by phone at (613) 233-3394 / Toll-free: 800-567-3863 or visit our website at www.tradex.ca

A Tradex advisor will help you interpret the results of your Retirement Income Forecast.

As part of the pre-retirement course, watch for our upcoming Webcast on October 25th, 2023, on the “Seven Common Mistakes in Estate Planning”

As part of the pre-retirement course, watch for our upcoming Webcast on October 25th, 2023, on the “Seven Common Mistakes in Estate Planning”